介绍:

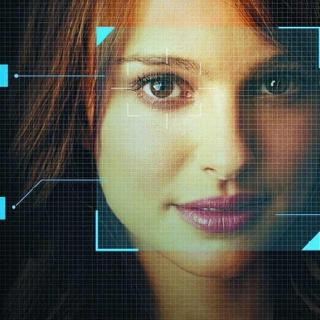

China will not be permitting banks to identify customers through biological traits anytime soon, amid a recent roll-out of biometric systems by some financial services companies.

Fan Shuangwen, deputy director of the central bank’s payment department, said at a forum on May 24 that the People's Bank of China will not be permitting banks to use biometric-based ID systems until technological standards are established.

New customers are required to appear at banks in person and some experts have suggested using facial recognition technology to replace on-site visits.

Ant Financial Services Group, affiliated with Alibaba Group Holding Ltd., recently unveiled a “smile to pay” technology which allows users to have their face scanned instead of typing in a password when making a payment online. The company has said the regulator should allow banks to try biometrics given security vulnerabilities with in-person visits to banks for verification.

An expert from the Ministry of Public Security told Caixin that biometric information is highly susceptible to identity theft. The lack of strong enough electronic security safeguards has been the main reason why no other country relies on biometric systems as a primary ID tool.

For Caixin Online, this is Diana Bates.

5月24日,在清华五道口“新常态、新金融”全球金融论坛上,央行支付司副司长樊爽文表示,开户是金融业务的核心和基础,也是反洗钱、打击非法犯罪活动的基础制度之一。从这一点而言,监管态度是慎而又慎的,对远程开户要坚持标准先行,必须继续保障银行账户的实名制。

这也是监管部门第一次在公开场合回应“刷脸开户”。眼下,银行业特别是中小银行和互联网金融从业者对放开远程开户限制的呼声颇高。广发银行副行长王兵在前述场合建议,监管部门可以限制远程开户帐户的功能,以此方式来保障安全。蚂蚁金服首席战略官陈龙则认为,传统银行的柜台面签制度并不是百分之百无风险,而人脸识别技术的识别率也是比较高的,可以尝试用于远程开户。

此前一位公安部三所专家曾告诉财新记者,无论人脸识别、指纹等多重生物识别技术有多成熟,只要是网络远程传输方式都能够被黑客截取复制,“这也是为何没有任何一个国家用人脸或指纹等生物识别技术作为金融业务身份识别的主要手段。”